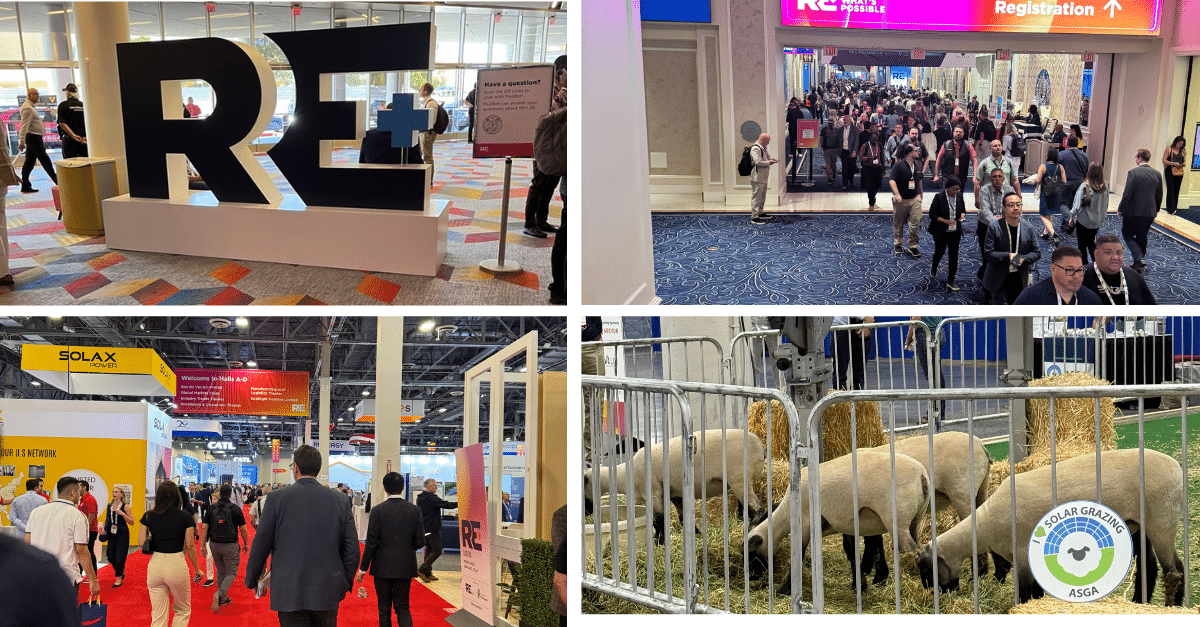

This year at RE+ 2025, the conversations were different. A focused resolve has replaced speculative excitement, with discussions centered not on future possibilities but on the urgent need to build in today’s complex reality. This pragmatic shift, evident as 37,000 attendees navigated a busy expo hall with more than 1,300 exhibitors, points to one clear conclusion: our industry’s momentum is not just strong, it’s determined.

That determined resolve is a direct response to a simple reality: immense opportunity now clashes with significant headwinds. While foundational demand for clean energy drives the industry forward, growth is challenged by trade friction, tariff risks and seismic policy changes from the “One Big Beautiful Bill Act” (OBBBA).

As we explored in our most recent issue of RE:NEW, the market’s focus has pivoted from aspirational visions to execution. The market now rewards the delivery of de-risked, operational assets — not just a promising pipeline — and the expertise required to make it happen.

Navigating a Post-Subsidy Landscape

At the forefront of these execution challenges — and a constant theme in the policy sessions at RE+ — is the industry’s adaptation to the accelerated phase-out of the federal Investment Tax Credit (ITC). Under the OBBBA, projects must begin construction by July 4, 2026, or be placed in service by the end of 2027 to qualify for the more favorable credits. On the show floor, this translated into a new emphasis in conversations, moving from cost-per-watt to supply chain certainty.

This has triggered a massive wave of “safe-harboring”. While always a critical financial tool, safe-harboring now also serves as a powerful market signal of strategic maturity, making it the ultimate differentiator in a market that prizes de-risking. At Standard Solar, we anticipated this, and our strategic safe harbor purchase, backed by the financial strength of our owner, Brookfield, de-risks our project pipeline for years, demonstrating why being well-capitalized is a core strategic asset for success.

From Promise to Performance

RE+ 2025 made it clear that the solar industry’s operating model has evolved from relying on incentives to focusing on execution. Today, value is measured less by the promise of future megawatts and more by the certainty of operational assets that generate predictable revenue. This focus on long-term value explains a key trend discussed throughout the conference: traditional service providers like EPCs and Operations & Maintenance (O&M) firms are now pursuing asset ownership, seeking to capture that predictable revenue stream for themselves.

But turning a pipeline into a portfolio of revenue-generating assets has never been more complex.

Navigating the Gridlock

At the heart of that complexity lies what panelists across the conference called the industry’s most significant operational hurdle: the gridlock in our nation’s interconnection queues. The problem is especially acute for distributed generation (DG) projects. At the conference, we heard from developers whose project timelines have been significantly extended by interconnection delays that now stretch well beyond a year, jeopardizing the viability of their projects.

In this environment, our long-standing ability to develop greenfield opportunities becomes a true strategic differentiator. Our expertise in site selection, grid analysis and utility engagement is essential, particularly at the state level where policy can have the most immediate impact. We also heard in developer roundtables that expertise must now include earning a “social license” — the community’s trust and approval — to prevent the local opposition that can halt even well-planned projects.

Capitalizing on New Growth Engines

This execution-focused mindset extends to capitalizing on new growth engines that require clean, reliable power in substantial new volumes.

The expanding market for battery energy storage systems (BESS) presents a significant growth opportunity, with the market poised for a 35% increase in annual additions this year alone. There was even a special section on the exhibit floor dedicated to batteries, underscoring that storage is no longer an add-on but a core component of the energy future. While many solar + storage projects still rely on incentives to pencil out, this combination represents the most effective path forward to deliver clean energy with resilience and reliability. As the grid requires greater stability, Standard Solar is actively pursuing these vital storage opportunities.

But perhaps the most talked-about trend in every breakout session and networking event was the explosive energy demand from data centers. Fueled by AI, their power needs are projected to surge 165% by 2030, creating a systemic constraint our grid cannot handle. This creates a prime market segment in the 25–80 MW range that Standard Solar is well-positioned to serve. Because data centers require 24/7 reliable power, pairing solar with battery storage is the ideal solution, making the data center boom a primary driver for large-scale BESS.

Your Partner for a New Era of Energy

RE+ 2025 confirmed the solar industry’s transition into a new phase of maturity. While the challenges remain, the opportunities for resilient, well-prepared companies are greater than ever. Success in this new era requires a precise combination of strengths — a value proposition Standard Solar is built to deliver. The path forward is not simple, but it is clear, and it will be defined by partners as resilient and reliable as the systems we build — and the future we are powering together.

Ready to build a resilient energy future? Let’s connect.

More Recent Blog Posts

The Budget Barrier: A New Financial Path for School Solar

February 24, 2026

Standard Solar · 3 min read

Massachusetts: A Visionary State in Community Solar Growth

February 13, 2026

Standard Solar · 3 min read

Unlocking Student Imagination with Solar Energy

January 20, 2026

Standard Solar · 4 min read

Delivering on Our Promise: 2025 in Review

December 11, 2025

Scott Wiater · 3 min read

Share